Relative Money and Starbucks

I was recently walking past Equinox, the fancy $250/mo gym, and was thinking about at what level of income you’d have to be at for that to be a no-brainer, “Starbucks coffee”-level, decision. As a somewhat regular person (or so I’d like to think) the idea of paying for such an expensive gym (the one down the road charges only $40/mo) seems insane - but if you make a metric butt load of money, it’s not even worth your energy to worry about. How much does that Super Rich person make, and what does it tell us about money being relative to our purchasing power?

Setting definitions 🔗︎

Let’s establish a baseline that a new college-grad, or maybe tradesperson like a plumber, making $65k/year considers an individual Starbucks drink to have a trivial effect on their finances.

I’m considering Trivial to be: even if you do it 10 times a month, it has a low impact on your budget.

With this definition, it sets our purchase threshold at 0.1% of monthly income - 10x would be only 1%. If we set our threshold to 1% though, 10x is 10%! 10% is a big chunk of rent/groceries/etc, so that’s a no-no.

Nick M. came to a similar conclusion when discussing the Climbing the Wealth Ladder , though for net worth:

This data point might seem random, but 0.01% is a good proxy for what constitutes a trivial amount of money for any level of wealth. For example, if you had a net worth of $10,000, paying $1 more (or 0.01% more) for something shouldn’t affect your finances in the slightest.

When Equinox == Starbucks 🔗︎

With our definition of trivial purchase set, how does our Starbucks-wielding friend fare?

- Starbucks coffee ~ $5

- $65k => $5400/mo

- 5/5400 = 0.0925%

That’s less than our threshold of 0.1%! If we follow that same ratio, what would their Super Rich Friend need to make for the fancy gym membership to be a no-brainer like a coffee?

- 0.0925% = $250 / X (monthly income)

- X = $270k/mo, or $3.2 million/yr!

Find your trivial purchase price 🔗︎

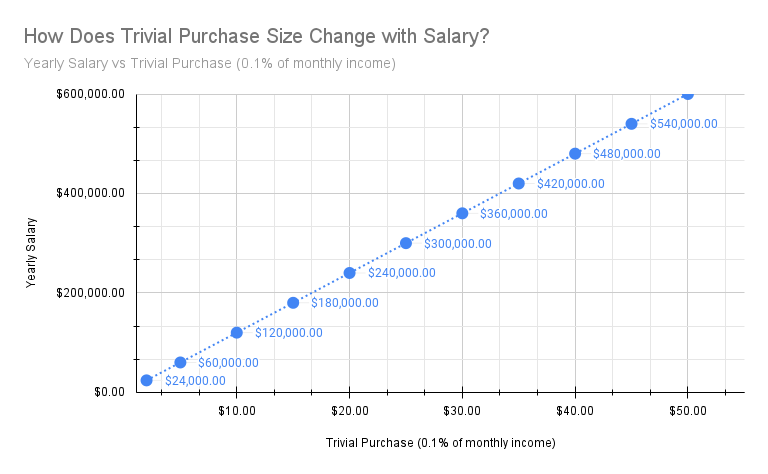

Now that we see how it works under the hood, this chart maps out a ratio of 0.1% of monthly income vs a yearly salary to understand how it scales up and down. Unfortunately our Super Rich friend doesn’t even show up on this chart!

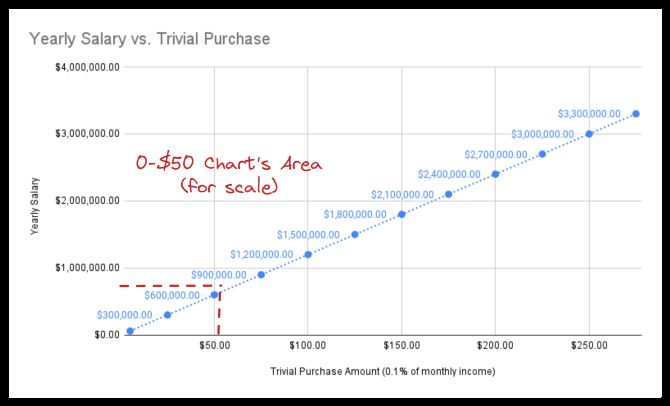

If we actually want to see them on a chart, we have to scale up by a lot.

What to do with this information 🔗︎

If you’re like me and fret over tiny purchases, by finding your trivial purchase price, you can start to understand where you might be wasting your energy deliberating.

Something to also consider if you’re a money-worrier, is the value of your time - The magic of doing $10,000 per hour work | RadReads .

I highly recommend reading the excellent exploration into the ideas presented in Climbing the Wealth Ladder .

See Also

- The Lack of a System is Still a System

The lack of a system is still a system, in the same way that the lack of a decision is a form of decision. You chose to delay making a choice. It's a choice to not expend energy making a system, and let one form organically out of chaos.

- Potential Treatments for Institutional Knowledge

This is my living reference doc for to explore potential ways to reduce the amount of institutional knowledge a group relies on.

- How Pieter Levels Optimizes for Freedom

Pieter Levels uses money & life choices to optimize for freedom and simplicity.

- The Man in the Arena has Glowing Fingers

I saw 'The Man in the Arena' - and he wears LED-tipped gloves and a snazzy hooded boxer's robe.

- Niche Single-Purpose Programming Languages

Programming languages that do one thing, and do it well.